Colonie Ny Property Tax Rate . The assessment roll is indexed alphabetically by street and broken into multiple parts for. the exact property tax levied depends on the county in new york the property is located in. The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. All taxpayers now have the option to pay property tax bills in two installments. The first installment of ½ of. Westchester county collects the highest. Our department is responsible for assessment administration of over 32,000 parcels for real property tax. If you're having trouble searching for your bill, try using only one search field at a time (i.e. generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. 2024 final assessment roll *. Each of the sections within the town depicted above have a different entry in the tax. Only your bill # or property address).

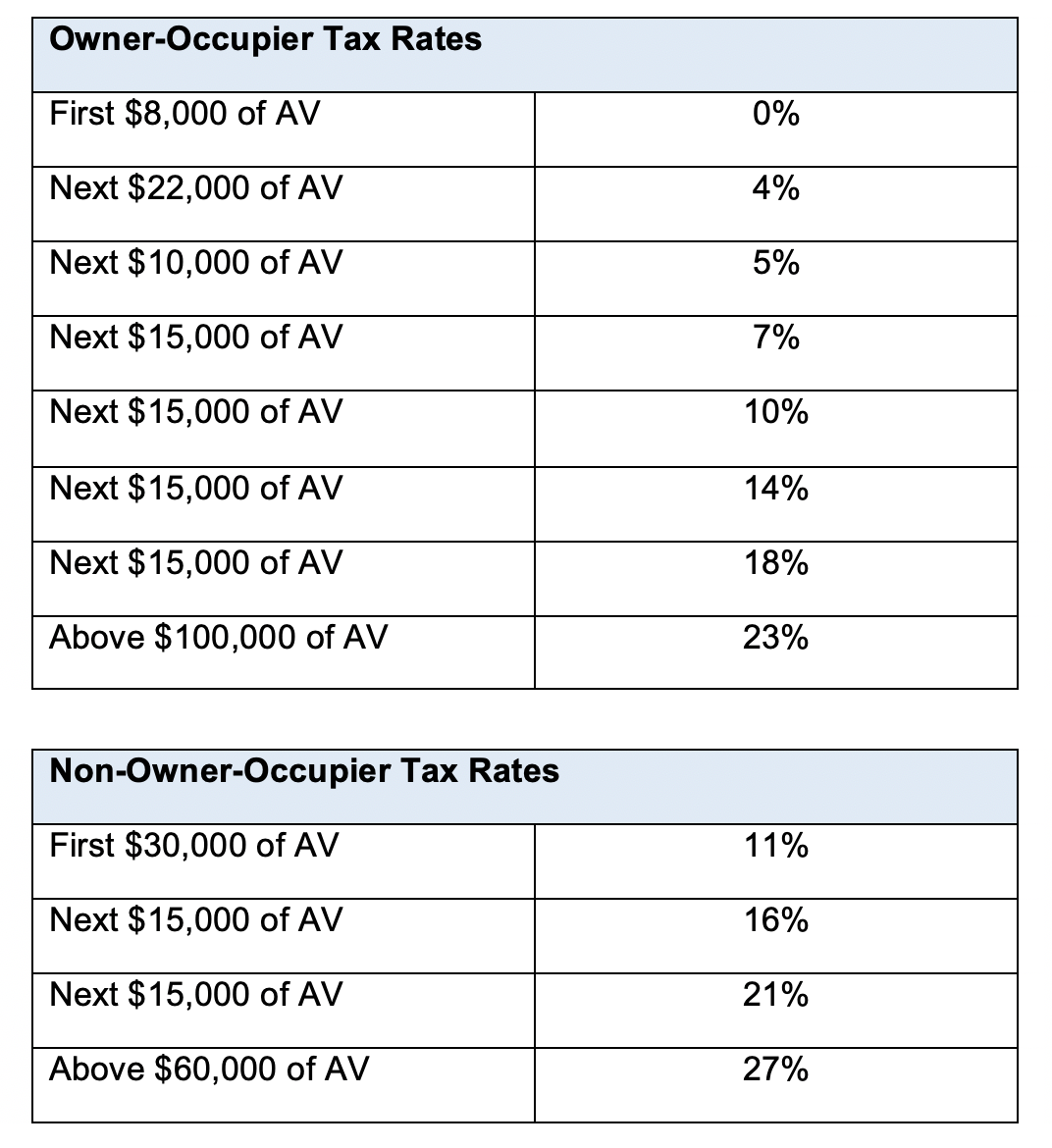

from www.mof.gov.sg

If you're having trouble searching for your bill, try using only one search field at a time (i.e. Each of the sections within the town depicted above have a different entry in the tax. The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. Only your bill # or property address). The first installment of ½ of. the exact property tax levied depends on the county in new york the property is located in. 2024 final assessment roll *. Westchester county collects the highest. generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. Our department is responsible for assessment administration of over 32,000 parcels for real property tax.

MOF Press Releases

Colonie Ny Property Tax Rate The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. the exact property tax levied depends on the county in new york the property is located in. The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. Only your bill # or property address). generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. Our department is responsible for assessment administration of over 32,000 parcels for real property tax. If you're having trouble searching for your bill, try using only one search field at a time (i.e. The assessment roll is indexed alphabetically by street and broken into multiple parts for. The first installment of ½ of. Each of the sections within the town depicted above have a different entry in the tax. All taxpayers now have the option to pay property tax bills in two installments. 2024 final assessment roll *. Westchester county collects the highest.

From www.empirecenter.org

New York Property Tax Calculator 2020 Empire Center for Public Policy Colonie Ny Property Tax Rate Our department is responsible for assessment administration of over 32,000 parcels for real property tax. The first installment of ½ of. Each of the sections within the town depicted above have a different entry in the tax. Westchester county collects the highest. All taxpayers now have the option to pay property tax bills in two installments. If you're having trouble. Colonie Ny Property Tax Rate.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Colonie Ny Property Tax Rate Westchester county collects the highest. 2024 final assessment roll *. Each of the sections within the town depicted above have a different entry in the tax. generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. Our department is responsible for assessment administration of over 32,000 parcels for real property tax. The first. Colonie Ny Property Tax Rate.

From www.empirecenter.org

New York Property Tax Calculator 2021 Empire Center for Public Policy Colonie Ny Property Tax Rate The first installment of ½ of. 2024 final assessment roll *. generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. The assessment roll is indexed alphabetically by street and broken into multiple parts for. If you're having trouble searching for your bill, try using only one search field at a time (i.e.. Colonie Ny Property Tax Rate.

From talyayharriett.pages.dev

New York State Tax Brackets 2024 Heddi Kristal Colonie Ny Property Tax Rate Each of the sections within the town depicted above have a different entry in the tax. If you're having trouble searching for your bill, try using only one search field at a time (i.e. Westchester county collects the highest. The assessment roll is indexed alphabetically by street and broken into multiple parts for. generally, the property tax rate is. Colonie Ny Property Tax Rate.

From alysharizzicone.com

Colonie, NY Real Estate Market Update 10/27/2023 Alysha Rizzicone Colonie Ny Property Tax Rate If you're having trouble searching for your bill, try using only one search field at a time (i.e. generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. Westchester county collects the highest. The assessment roll is indexed alphabetically by street and broken into multiple parts for. Our department is responsible for assessment administration. Colonie Ny Property Tax Rate.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Colonie Ny Property Tax Rate The assessment roll is indexed alphabetically by street and broken into multiple parts for. Only your bill # or property address). The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. All taxpayers now have the option to pay property tax bills in two installments. If you're having trouble searching for your bill,. Colonie Ny Property Tax Rate.

From changecominon.blogspot.com

Nyc Property Tax Rates By County change comin Colonie Ny Property Tax Rate If you're having trouble searching for your bill, try using only one search field at a time (i.e. Each of the sections within the town depicted above have a different entry in the tax. Our department is responsible for assessment administration of over 32,000 parcels for real property tax. Only your bill # or property address). generally, the property. Colonie Ny Property Tax Rate.

From changecominon.blogspot.com

Nyc Property Tax Rate Condo change comin Colonie Ny Property Tax Rate Westchester county collects the highest. If you're having trouble searching for your bill, try using only one search field at a time (i.e. Each of the sections within the town depicted above have a different entry in the tax. Only your bill # or property address). All taxpayers now have the option to pay property tax bills in two installments.. Colonie Ny Property Tax Rate.

From www.mof.gov.sg

MOF Press Releases Colonie Ny Property Tax Rate The assessment roll is indexed alphabetically by street and broken into multiple parts for. Only your bill # or property address). Westchester county collects the highest. 2024 final assessment roll *. Our department is responsible for assessment administration of over 32,000 parcels for real property tax. generally, the property tax rate is expressed as a percentage per $1,000. Colonie Ny Property Tax Rate.

From anchorcapital.com

Understanding & Addressing an Estate Tax Liability Anchor Capital Colonie Ny Property Tax Rate Our department is responsible for assessment administration of over 32,000 parcels for real property tax. Only your bill # or property address). If you're having trouble searching for your bill, try using only one search field at a time (i.e. Each of the sections within the town depicted above have a different entry in the tax. The first installment of. Colonie Ny Property Tax Rate.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index Colonie Ny Property Tax Rate If you're having trouble searching for your bill, try using only one search field at a time (i.e. All taxpayers now have the option to pay property tax bills in two installments. the exact property tax levied depends on the county in new york the property is located in. The tax office is responsible for the collection of school. Colonie Ny Property Tax Rate.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Colonie Ny Property Tax Rate The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. the exact property tax levied depends on the county in new york the property is located in. Only your bill # or property address). The first installment of ½ of. All taxpayers now have the option to pay property tax bills in. Colonie Ny Property Tax Rate.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Colonie Ny Property Tax Rate Only your bill # or property address). All taxpayers now have the option to pay property tax bills in two installments. the exact property tax levied depends on the county in new york the property is located in. The first installment of ½ of. The assessment roll is indexed alphabetically by street and broken into multiple parts for. . Colonie Ny Property Tax Rate.

From myemail.constantcontact.com

does your state impose high taxes? Colonie Ny Property Tax Rate The first installment of ½ of. If you're having trouble searching for your bill, try using only one search field at a time (i.e. the exact property tax levied depends on the county in new york the property is located in. Only your bill # or property address). 2024 final assessment roll *. Westchester county collects the highest.. Colonie Ny Property Tax Rate.

From www.hauseit.com

The Complete Guide to Closing Costs in NYC Hauseit® Colonie Ny Property Tax Rate Our department is responsible for assessment administration of over 32,000 parcels for real property tax. Westchester county collects the highest. Each of the sections within the town depicted above have a different entry in the tax. All taxpayers now have the option to pay property tax bills in two installments. Only your bill # or property address). The assessment roll. Colonie Ny Property Tax Rate.

From www.timesunion.com

What will Colonie's development look like in a decade? Colonie Ny Property Tax Rate The assessment roll is indexed alphabetically by street and broken into multiple parts for. Westchester county collects the highest. The first installment of ½ of. If you're having trouble searching for your bill, try using only one search field at a time (i.e. the exact property tax levied depends on the county in new york the property is located. Colonie Ny Property Tax Rate.

From www.empirecenter.org

How to compare property taxes in New York Empire Center for Public Policy Colonie Ny Property Tax Rate The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. Only your bill # or property address). The assessment roll is indexed alphabetically by street and broken into multiple parts for. All taxpayers now have the option to pay property tax bills in two installments. Each of the sections within the town depicted. Colonie Ny Property Tax Rate.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Colonie Ny Property Tax Rate generally, the property tax rate is expressed as a percentage per $1,000 of assessed value. The tax office is responsible for the collection of school and property taxes for over 30,000 parcels. The assessment roll is indexed alphabetically by street and broken into multiple parts for. If you're having trouble searching for your bill, try using only one search. Colonie Ny Property Tax Rate.